Infographic

Brands are exploring how servitization can help them extend the customer relationship beyond the point of purchase

What Is It?

From grocery stores to streaming platforms, brands are exploring how a shift from selling goods to offering products as-a-service can extend their customer relationships beyond the point of purchase.

-

IT and Technology

The as-a-service business model was pioneered by the software industry and dubbed Software- as-a-Service, or SaaS. It was enabled by the internet, which made everything more accessible, and allowed companies to lease software from providers instead of buying it outright. Now, the IT and technology Anything-as-a- Service market (also known as XaaS) also covers hardware and infrastructure.

-

Retail and Banking

XaaS is enabling financial services and products to be embedded into other consumer activities, such as e-commerce, travel, retail, health, and telecom. Someone could buy a travel insurance policy, for instance, when they book a holiday online. Or they could take out a loan when they purchase a high value item, such as jewelry or furniture, and pay for it using a buy-now-pay-later (BNPL) model.

-

Consumer goods

Consumer-facing brands are realizing the value of customer data, and offering digital services that enable them to connect more deeply with their customers is a great way to collect it. From subscription boxes to membership programs, these services enable brands to establish long-lasting relationships with their customers, while accumulating valuable first- party data.

-

Entertainment

Streaming services such as Spotify, Netflix, and Disney+ are the ultimate as-a-service brands. Rather than buying music albums or movies, customers have access to them for as long as they pay their subscription. These digital- native businesses leverage the enormous swaths of customer data their digital platforms collect to continuously improve and personalize CX.

-

Transport and Travel

The as-a-service model is transforming how every sector operates, from manufacturing to transportation. Rolls Royce even provides its jet engines as-a- service on a fixed price per flying hour basis. Automotive OEMs are also exploring how Mobility-as-a- Service can enable them to reach new customer segments with pay-per-use offerings.

Case Study

Embedded insurance: Tesla and the embedded customer journey

Tesla was an early adopter of embedded finance when it bundled insurance into the customer purchase journey.1 By offering embedded insurance, Tesla is able to provide a more seamless integrated value proposition to its customers, allowing them to purchase insurance directly when purchasing a vehicle, without going through a third party. Not only does this streamline the customer experience, it helps Tesla boost revenues, increase customer loyalty, and can be used to unlock new high-value services that provide deeper insights into their customers. For example, Tesla expanded on this offering earlier this year, when it launched its real-time insurance product. Now available in seven US states, this embedded insurance product offering uses real-time driving data to assess driver behaviour and accident risk more accurately, allowing it to provide lower cost cover than traditional insurers.

Why Now?

XaaS growth is being driven by cloud computing, which enables the servitization of everything from hardware to software. Also key, is the prioritization of building and maximizing direct-to-consumer relationships, which can generate annually recurring revenue. In the last 10 years, XaaS has proliferated into a wide variety of sectors, ranging from content services to subscription food boxes. In 2023 we’ll see the next phase of growth, as brands strive to sustain customer relationships, gain a more complete understanding of their audiences, and deliver personalized omnichannel experiences.

Banking-as-a-Service

Embedded finance, which is part of Banking-as-a- Service, is growing as non-finance brands such as travel companies and retailers seek to create more holistic offers, reduce friction in the purchase journey, and improve the customer relationship. Bain & Company estimates the value of transactions flowing through embedded finance will triple from $2.6 trillion in 2021 to $7 trillion in 2026. Payments and lending will lead the way, followed by value-added services such as insurance.2

Mobility-as-a-Service

The Mobility-as-a-Service market, known to many of us through rideshare services such as Uber, as well as shared urban transport solutions for bikes and scooters, will transform the transport industry. The market is growing rapidly due to the rising cost of owning a car, and an increasing awareness of the environmental impact of driving. It is expected to reach $122 billion by 2026.3

Commerce-as-a-Service

The e-commerce subscriptions market – which includes meal kits, grooming products, and fashion subscription boxes – is already changing what we buy and how we buy it. It will experience enormous expansion over the next four years, growing from a $120 billion market in 2022 to a $904 billion market by 2026.4

These new B2C services are distinct from the largely B2B services that have already been completely transformed by XaaS. And while the approach brands are taking to servitize their products varies across sectors, all of these services represent a changing perspective from selling products to selling outcomes.

This paradigm shift puts the focus on the customer experience. Everywhere we look brands are using servitization to establish deeper customer relationships that are about more than just selling products, to gain a better understanding of their customers.

Market size and forecast growth of selected as-a-service markets5

Analysis - Consumer View

Consumers already use a wide range of subscription services

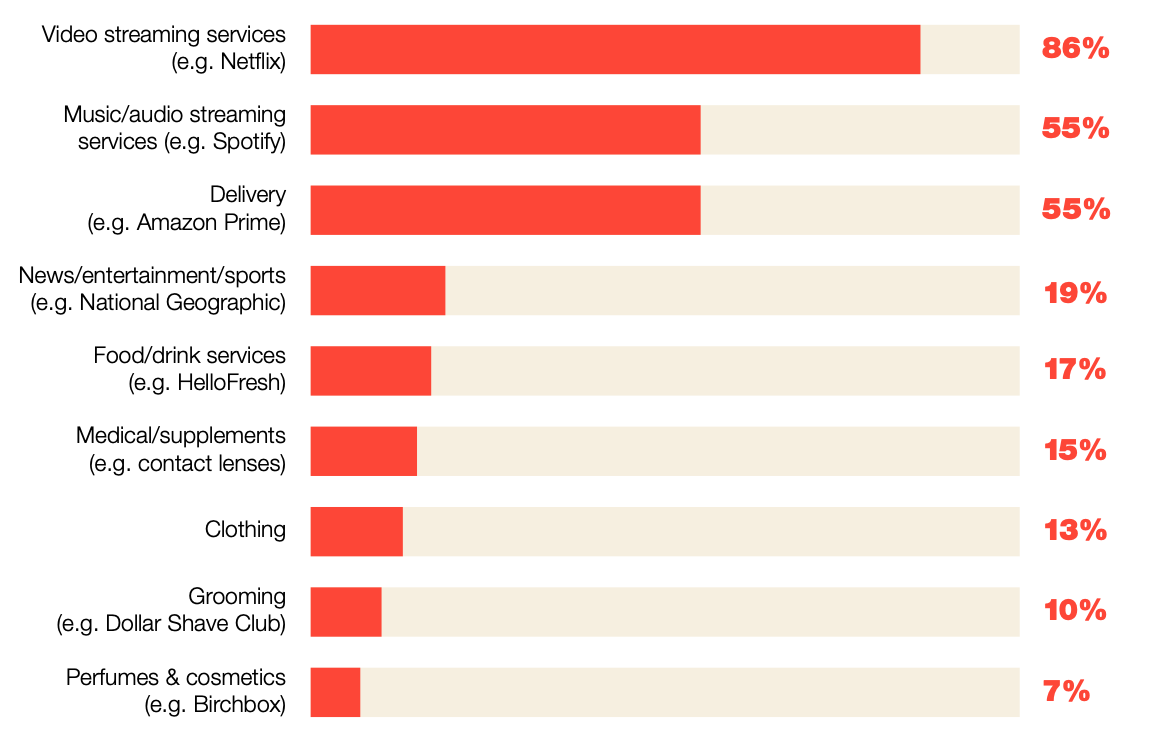

Anything-as-a-Service is already well embedded in the consumer sector in the form of subscription services. Video streaming services are the most common type of subscription (an average of 2.1 per person), followed by music and delivery services (0.8 per person). Consumers are increasingly happy to share their data with these services in return for the personalized benefits and rewards they provide.

A 2022 report from the Global Data and Marketing Alliance (GDMA) indicates a growing preference for data sharing-led value exchange models, with roughly equal numbers of consumers preferring to share data to receive music or video streaming services for free as prefer to pay for them directly.

Video streaming services are by far the most popular subscription service among those that subscribe to at least one service

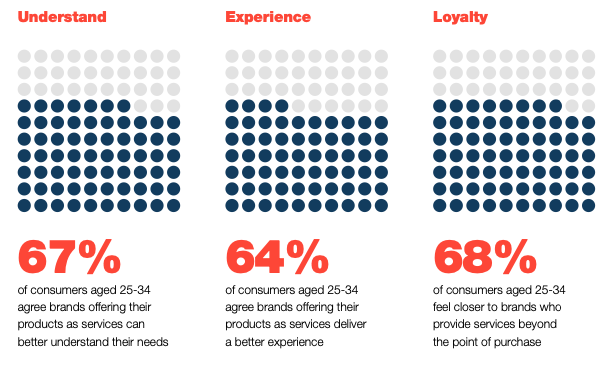

Consumers believe service-based offerings can improve their experience

While the reasons consumers subscribe to these services vary considerably by product, there are a number of recurring themes. The majority (57%) of consumers agree they get a better customer experience when brands offer their products as services, while 54% feel brands who adopt service-based models can better understand their needs. Younger consumers in particular see servitization as a way of improving their experience. Over two-thirds of consumers aged 16-34 feel closer to brands who provide them with services beyond the point of purchase.

Service-based products bring many benefits to the consumer

Consumers are very positive about embedded finance even though usage remains low

According to our consumer survey, less than a third (31%) of consumers have used embedded finance offerings from non-financial companies such as retailers or ecommerce sites, but satisfaction among adopters is high. In fact, over three-quarters of consumers who have tried financial services like BNPL are open to using them again.

For embedded payments, the appeal for consumers is ease of use and value. For example, a customer can pay for their coffee using a closed-loop card with the coffeehouse chain and can potentially earn discounts or points through repeated purchases.

There is still some work to do to help consumers fully understand the benefits, however. Only half of 16-44 year-olds say they would trust their favorite non-financial brand to offer them financial services such as payments and embedded insurance.

But the rewards can be high for companies who do implement embedded finance, in terms of improved conversion rates. Almost half (49%) of 16-34 year-olds say they are more likely to make a purchase when a brand offers insurance as part of the sale.

of consumers have used embedded finance offerings from non-financial companies

of 16-34 year-olds say they are more likely to make a purchase when a brand offers insurance as part of the sale

of brands agree they can build better customer experiences through as-a-service models

Analysis - Company View

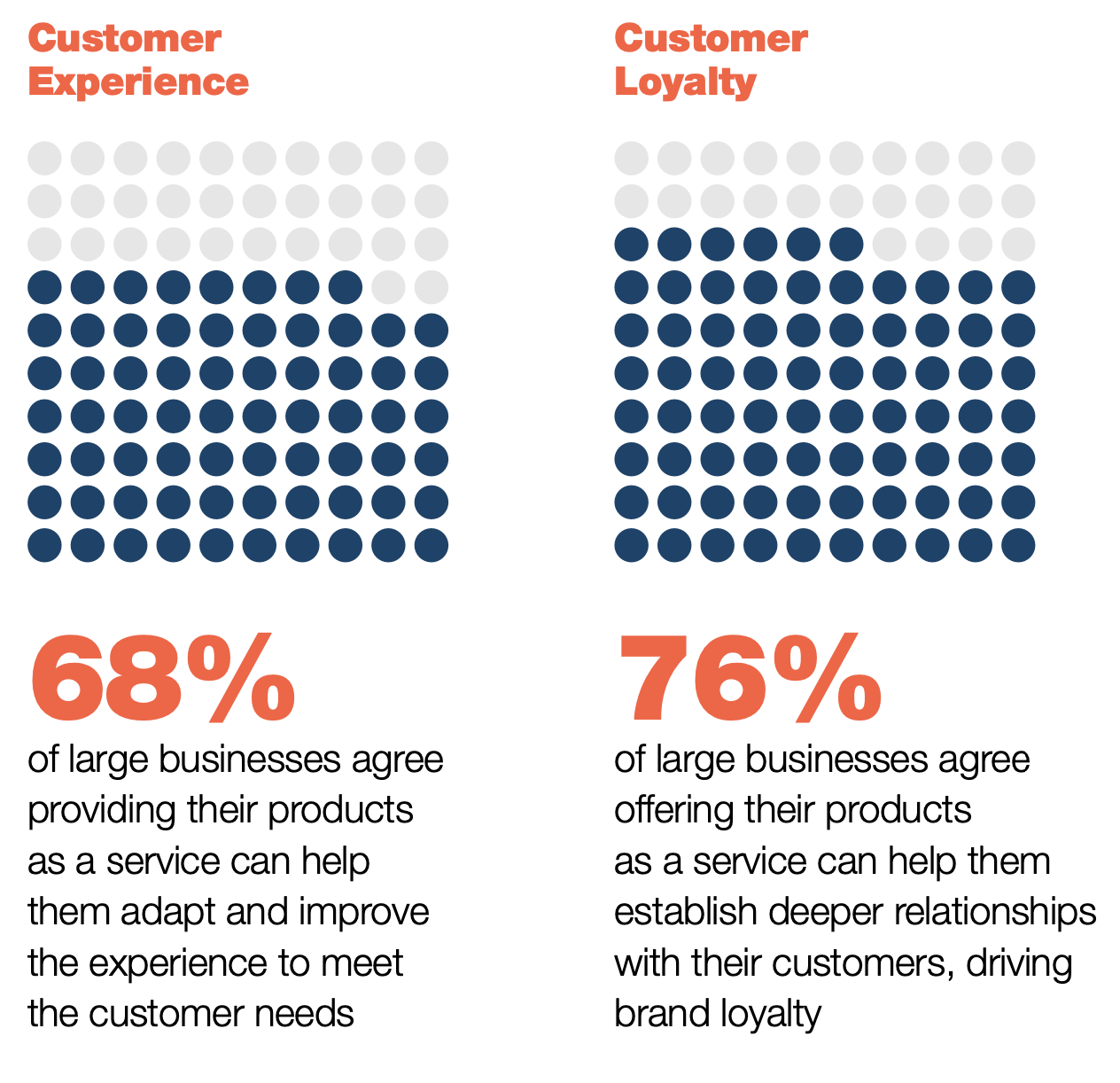

Service and subscription models help businesses build deeper relationships with their customers

Whether it’s transitioning toward a service or subscription model or embedding digital services into their platform, many businesses are beginning to see the value of exploring service-based offerings.

68% of brands agree they can build better customer experiences through as-a-service models, and a similar proportion believe offering products as-a-service can help them build deeper relationships and drive brand loyalty.

Traditional businesses are learning from digital-first innovators

The as-a-service model delivers a continuous stream of first-party data, helping businesses build a holistic view of their customers, their preferences, and their spending habits. This data, and the insights generated from it, can be used to refine the product, tailor offers, provide reminder services, and much more.

Data-driven digital-first companies have largely mastered the art of using the data their platforms collect to continuously improve the customer experience. In contrast, brands selling products through traditional, physical channels have limited visibility into who their customer is, what they buy, and how they behave – and struggle to personalize their offer as a result. In response, some brick-and- mortar retailers have integrated digital payments and reward programs into their offering in an attempt to build a more detailed understanding of what products their customers are buying, how frequently they’re visiting, and even how their buying habits vary across stores and channels. This data presents opportunities for brands to personalize all aspects of the customer experience, from offers and rewards to cross-sell and upsell activities.

From reward programs to integrated payments, traditional businesses are learning from digital-first innovators, and are building embedded services that enable them to connect customer data points to establish a complete view of each and every customer. As these services evolve and become increasingly integrated into every customer journey, traditional businesses are starting to unlock the value of customer data for delivering superior CX both online and in store.

Businesses perception of the key benefits of service-based models for CX

Embedded finance is emerging as a valuable tool for improving outcomes and CX

Embedded financial services such as BNPL can make products more affordable to a wider proportion of the population. At the same time, embedded insurance can increase customer confidence. Both of these factors lead to an increase in average basket value.

Perhaps most importantly, these services can extend the customer relationship beyond simply making a purchase, enabling brands to establish deeper connections with their customers.

Embedded finance offers benefits to both businesses and consumers

According to our survey:

of retailers believe embedded finance can increase average basket value

of retailers believe embedded financial services such as BNPL can improve checkout completion rates

of retailers agree embedded finance can help them better understand their customers, their spending habits, and their needs, and that this can help them deliver a better experience

Today, companies of all types and levels of maturity — including retailers, coffeehouse chains, grocers, telcos, big tech and software companies, car manufacturers, insurance providers, and logistics firms — are considering embedded financial services to serve both business and consumer segments.

To meet the rising demand for embedded finance, financial institutions are increasingly developing Banking-as-a-Service bundled offerings (often white- labeled or co-branded) that non-banks can use to serve their customers. This presents an exciting opportunity for the entire financial services ecosystem.

Financial institutions can reach a greater number of customers at a relatively low cost, and distributors can open up new lines of revenue while building deeper relationships with their customers.

Where next?

Brands are realizing the value that can be unlocked by Anything-as-a-Service

In 2023, we will see brands from all market sectors embrace the opportunities presented by the transition to the as-a-service operating model. A massive 84% of businesses believe companies in their industry will be more likely to offer service-based products in the next five years. This perception is particularly prevalent in retail (91%) and telecoms industries (95%).

Similarly, 75% of businesses believe companies will be more likely to offer embedded financial services to their customers in the next five years.

Businesses who embrace these opportunities will generate valuable first-party data that enables them to better understand the customer and offer personalized experiences across all channels.

“By 2023, 75% of organizations selling direct to consumers will offer subscription services, but only 20% will succeed in increasing customer retention.”

Gartner7

Digital-first businesses are still leading the way. Many have already implemented sophisticated customer data platforms (CDPs) that enable them to build constantly evolving customer portraits, at scale. Non digital-native brands are beginning to follow, and are connecting customer touchpoints across both physical and digital channels by embedding services into their offering or transitioning toward as-a-service models.

But customer understanding alone is not enough. The more effective digital-first businesses have built closed-loop models where they can act on the insights their systems generate, personalizing the service at an individual level, to drive satisfaction, customer retention, and ultimately customer lifetime value. In 2023 we will see more and more traditional businesses seeking to follow.

Seamless Service

Brands are combining automated tools and technologies with human-centered approaches to deliver best-in-class customer service and support.

References

Sources

1. tesla.com. Tesla Insurance.

2. bain.com. Embedded Finance.

3-5. MTM analysis using market size data from various sources including Business Insight, Future Market Insight, BCC Research. Adjusted for 2026 based on forecast CAGR.

6. acxiom.com. US data privacy: What the consumer really thinks in 2022.

7. gartner.com. Top 10 Trends in Digital Commerce.

Figure data

Market size and forecast growth graphic

Source: MTM analysis using market size data from various sources including Business Insight, Future Market Insight, BCC Research. Adjusted for 2026 based on forecast CAGR.

Video streaming services graphic

Source: MTM/Acxiom – CX Trends for 2023 – B2C Survey. Question: How many of each of the following types of subscription services do you subscribe to? Base: Total n = 2018.

Service-based products percentage graphic

Source: MTM/Acxiom – CX Trends for 2023 – B2C Survey. To what extent do you agree with each of the following statements about service-based products? Note: n = 2018.

Businesses perception graphic

Source: MTM/Acxiom – CX Trends for 2023 – B2B Survey. To what extent do you agree with each of the following statements about service-based products? Note: n = 200; Large businesses = 25% of total.