From standing in line at a bank branch to tapping an app — the way we manage our finances has transformed dramatically. Today, as organizations across many industries strive to deliver AI-enhanced customer experiences (CX), banks and other financial institutions aren’t just participating; they’re leading the charge.

They’re already using AI to guide customer decisions and orchestrate journeys. They’re crafting effortless experiences while safeguarding trust and personalization. And they’re moving quickly to harness conversational interfaces. The urgency is clear: 94% of banks and financial institutions believe AI-curated experiences will reshape CX faster than most brands are prepared for.

We interviewed 100 banking and financial service leaders based in the U.S. and U.K. for our 2026 CX Trends Report. They shared the significant pressures they face, their priorities for the coming year, and their innovative approaches to five AI-powered CX trends.

Read the report: AI-curated experience in banking →

What’s shaping CX strategy for financial services?

Customer experience has become a critical differentiator for banks and financial services companies. A diversified marketplace — disrupted by digital entrants, big tech players, and embedded finance solutions — has significantly raised customer expectations. Regulators are intensifying their focus on customer journeys and outcomes. And analysts are even warning that banking CX, globally, is in decline.

When asked about the external forces most profoundly shaping their CX strategy, financial leaders identified:

- The escalating demand for 24/7 personalized service

- Intensified competition from fintechs, neobanks, and major tech companies

- Evolving regulatory and compliance requirements

- Persistent economic pressures

Interestingly, business leaders in the U.S. and U.K. are responding with distinct priorities.

U.S. banks are more likely to prioritize enhancing personalization across channels and products and integrating with fintechs, super apps, and embedded finance ecosystems. U.K. banks are often focused on simplifying their digital and mobile banking interfaces.

However, financial institutions on both sides of the Atlantic share a common top CX priority: using AI to guide customers through complex financial decisions. This highlights a broad industry consensus on AI’s pivotal role in the future of banking experiences.

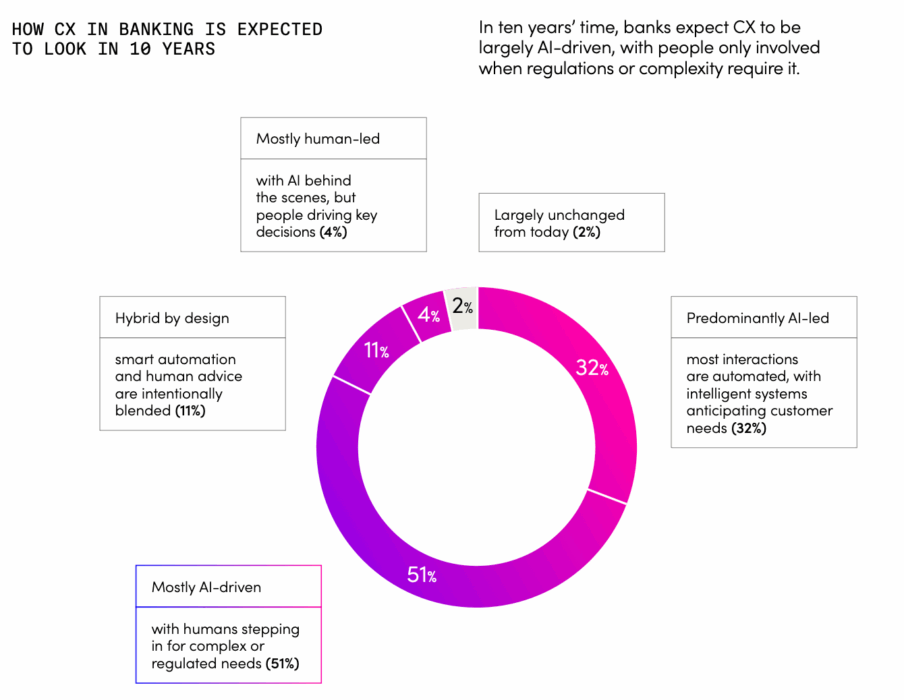

In fact, 83% of banking leaders believe CX will be predominantly AI-driven in the next 10 years, with human intervention reserved for complexity or regulatory needs. They aren’t just talking about it; they’re actively building this AI-curated future.

Beyond the hype: Banks are implementing conversational interfaces

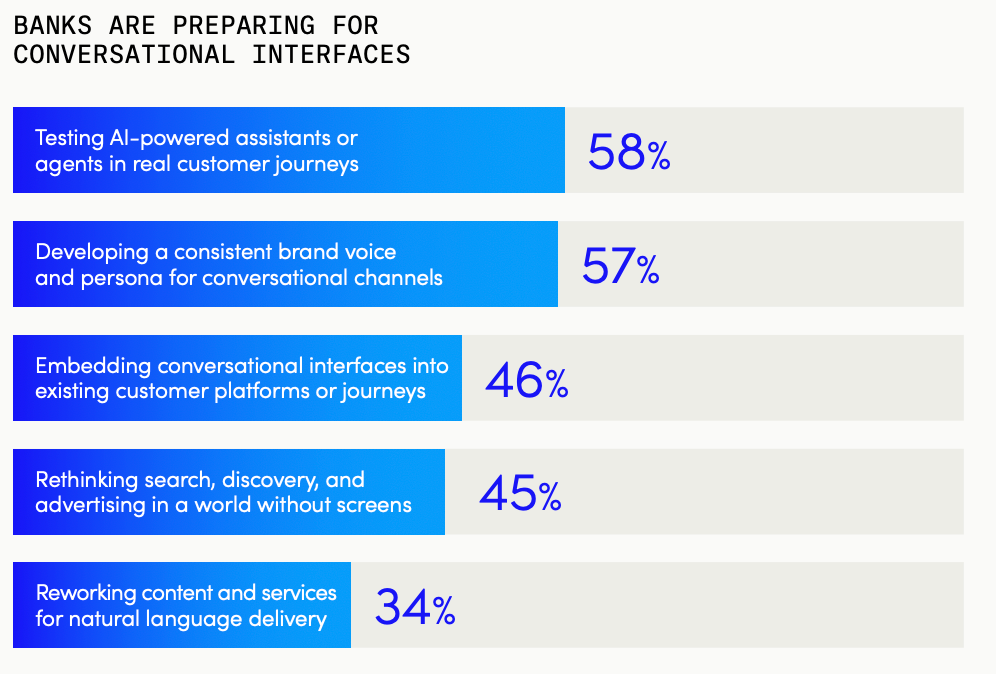

Financial services companies are leading other industries in implementing conversational interfaces. A substantial 77% are actively investing in this technology.

Most banks are diligently working on establishing a consistent brand persona for conversational channels and rigorously testing AI-powered assistants within real customer journeys. Nearly half (46%) are already embedding conversational interfaces directly into their customer journeys and technical platforms.

People are increasingly turning to voice and chat tools for product research and evaluation. This trend is so significant that 92% of banks acknowledge the imperative to adapt or risk being left out of the conversation entirely.

However, our research also indicates that banks will need to thoughtfully introduce conversational interfaces to customers to get them comfortable using them for everyday financial management. Our survey of 4,000 U.S. and U.K. consumers revealed that only 18% would choose a voice or chat assistant over a more established channel for tasks like transferring money between accounts. This underscores the need for a strategic, human-centric approach to AI adoption.

Financial institutions are stepping up AI guidance

The potential for AI to guide and support the banking customer experience is immense — from helping customers identify the best savings accounts to offering personal finance tips or flagging suspicious transactions.

Some financial services companies are already using AI to intelligently steer customer actions at every stage of the journey, and more than 90% say they plan to do so. This will be a welcome development for many customers, directly addressing the demand for 24/7 personalized service. The vast majority of people (83%) are open to AI influencing their decisions, though their comfort levels vary:

- 67% are comfortable with AI alerting them to fraud or security issues

- 41% are comfortable with AI assisting with mortgage or loan applications

- 35% are comfortable with AI making payments or transactions on their behalf

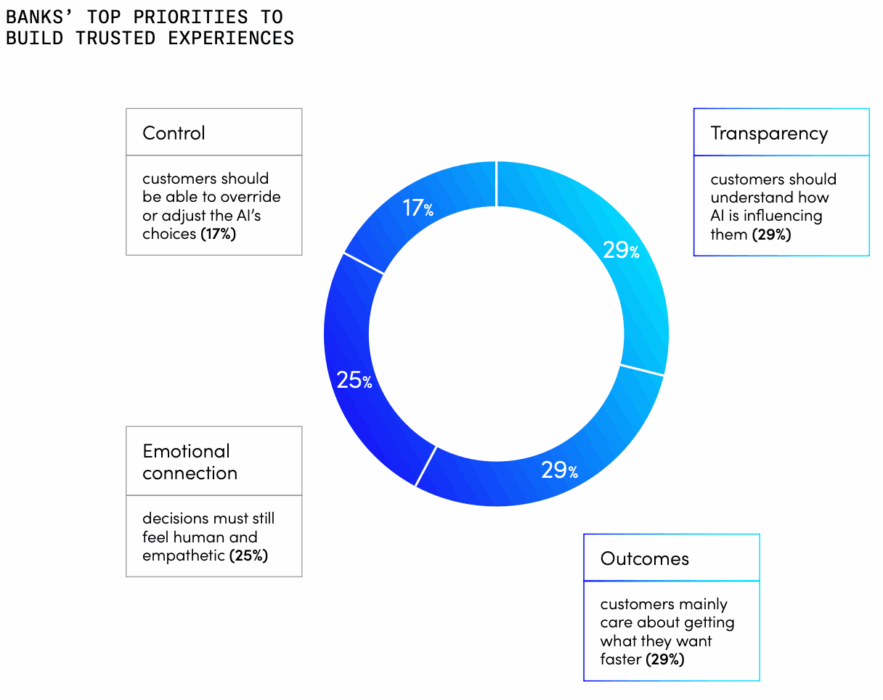

As banks build these trusted, AI-guided experiences, they are equally focused on delivering optimal outcomes and ensuring customers understand AI’s role. Consumers, above all, want the assurance that they can override AI’s choices when they want to, highlighting the importance of transparency and control in human-AI collaboration.

The delicate balance: speed and trust in CX

Almost every financial services company (90% of our sample) believes the next generation of customer loyalty will be defined by effortless experiences.

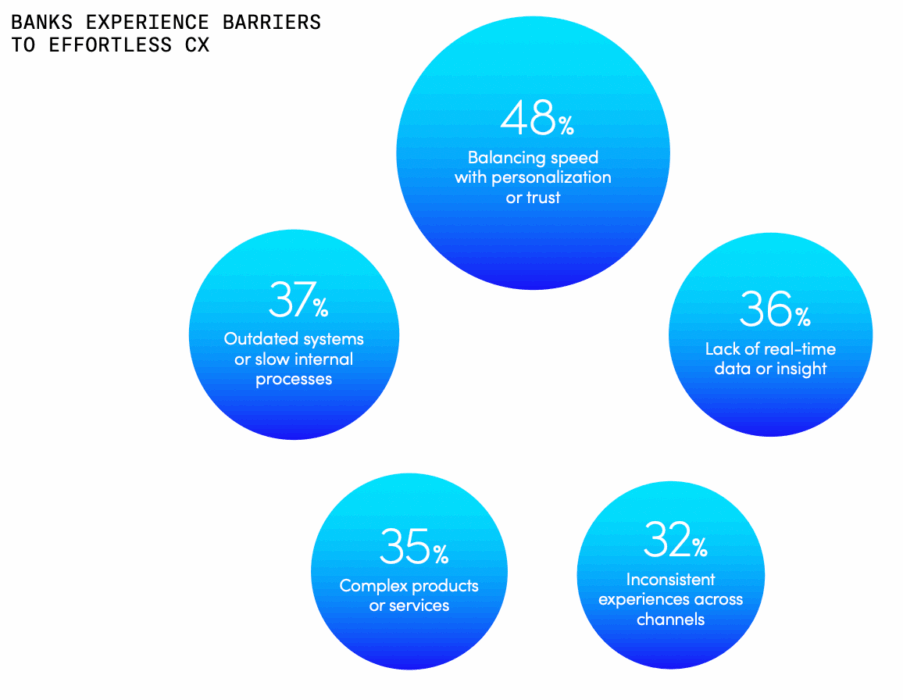

Yet, the path to effortless CX is fraught with challenges, from outdated systems and slow processes to fragmented data. The most prevalent obstacle, cited by 48% of banks, is the critical need to balance speed with the imperative to build trusted, personalized experiences.

With 82% of banking leaders believing the trend toward AI-curated, effortless CX will transform their industry in the next 12 months, the pressure is on. Financial institutions must square this circle, delivering banking experiences that are simultaneously tailored, reassuring, fast, and friction-free. This is where a robust, connected data foundation becomes indispensable.

Bringing every customer along for the ride

In the race toward AI-curated customer experiences, financial services companies are largely outpacing their peers in other industries. As they push to maximize technology and use AI to support, guide, and simplify experiences, the smartest banks will meticulously analyze how customer acceptance varies across demographics and different CX scenarios. As we’ve seen, consumer comfort with AI remains lower when their money is actively in motion.

To gain this deep understanding of customer needs, and to provide AI with the precise information it requires to curate exceptional, human-centric experiences, banks must start with a solid foundation of connected data and identity. This is precisely where Acxiom excels. We put data to work, solving these complex challenges for the world’s leading financial brands, ensuring they realize the full power and potential of their data and technology investments.

Read the full report

This article covers only a selection of the findings from our study. Read the full report and you’ll discover:

- Where banks and financial services companies see empathic AI delivering value

- How they’re responding to unifying AI-driven platforms

- How people feel about a wide range of AI/CX use cases

- Details of our research methodology and sample