The rise of AI is shaking up every stage of the customer journey. And insurance companies, like all other commercial enterprises, are feeling the shockwaves.

AI is changing the way many people shop for their perfect policy. It’s also raising their expectations regarding product personalization and customer support.

We wanted to understand how insurers are responding – how they’re rethinking customer experience (CX) in a world that’s being transformed by AI in all its forms, from conversational to generative to agentic. So, we asked them.

We interviewed 100 leaders at U.S. and UK insurance companies, exploring their CX challenges, priorities, and strategies. You can find the full picture in our 2026 CX Trends Report, or read on for a snapshot of our findings.

Read the report: AI-curated experience in insurance →

Insurers are connecting CX across fragmented platforms

How do you deliver a seamless customer experience when your customer journeys are often broken across multiple platforms, partners, and ecosystems?

It’s a huge question for insurers, given the industry’s complex landscape of brokers, price comparison sites, and third-party providers, from retail banks to travel and mobile phone companies. It’s also a question AI is helping solve.

The majority of insurers (63%) say they’re implementing AI to orchestrate people’s journeys across touchpoints or partners, as they work to create a cross-platform customer experience.

Insurers are embracing conversational interfaces

Most insurance brands (61%) are already testing AI-powered assistants in real customer journeys. And it’s easy to understand why – conversational interfaces, whether voice or text-based, could be the key to providing policyholders with quick, highly personalized service and support, 24/7.

What’s more, a significant proportion of people say they are as happy to interact with a bot as they are to ask their questions to a human. We canvassed the opinions of 4,000 U.S. and U.K. consumers in our study. Nearly one in three (30%) would prefer to use a voice or chat assistant when they have a question about what their policy covers. That’s more than would choose to consult the insurer’s website or app (27%), and the same proportion that would turn to a call center (30%).

But conversational interfaces are creating new risks for insurers, too. As voice and chat searches replace many traditional web-based inquiries, insurers know they need to adapt their strategy. Almost nine of 10 (88%) insurance leaders say brands that don’t adapt risk vanishing from the conversation. Almost half (49%) say they’re already rethinking search, discovery, and advertising for a world without screens.

Insurers are using AI to steer the customer experience

Insurers’ plans for AI-curated CX extend far beyond building bots to field questions. Increasingly, they’re also using the technology to steer people’s actions – in real time, at every stage of the customer lifecycle.

Weaving AI into every key moment, from awareness to retention, is no simple task. Most insurers are running into multiple logistical and strategic challenges, the most common being:

- Integrating AI with existing platforms or workflows

- Aligning AI decisions with brand experience or tone

- Budget or resource constraints

- A lack of in-house knowledge or skills

- Uncertainty around customer acceptance or comfort

Interestingly, customer comfort with AI calling the CX shots could be less of a cause for concern than many insurance leaders might think.

Yes, a small proportion of people (17%) bridle at the idea of brands using AI to influence their decisions in any way. But many are ready for the technology to offer a helping hand in the right context. The majority (52%), for example, say they’re comfortable with AI suggesting the right insurance policy for their individual requirements.

The primary forces driving CX reinvention

What’s the single greatest force pushing insurance leaders to reshape CX strategy and make the most of AI? That depends on whether they spread jam or jelly on their toast.

More than any other external factor, U.K. insurers are responding to growing competition from insurtechs and direct-to-consumer models. Insurers in the U.S., meanwhile, are most likely to be responding to rising customer expectations around personalized, proactive risk management.

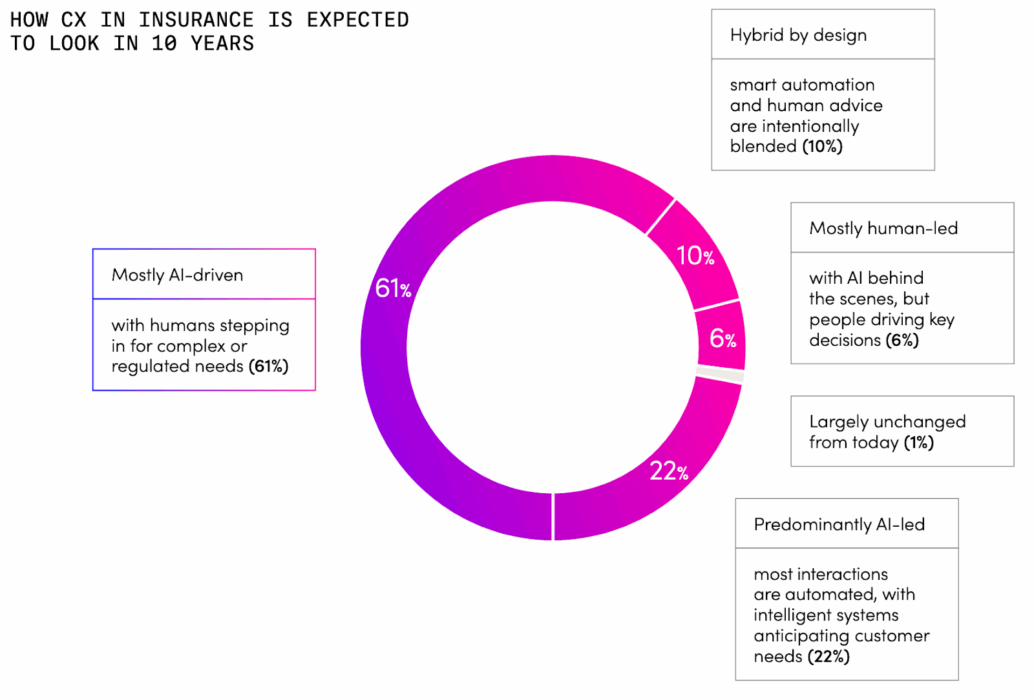

Whatever their primary motivation for rethinking CX, insurers are largely united in their vision of the industry’s future. More than eight of 10 (83%) say insurance CX will be AI-led within 10 years, with humans only stepping in where circumstances or regulations demand.

Minimizing the risks; seizing the opportunities

Insurance companies know they can’t sleep on CX transformation. As people’s search habits change, these companies feel the urgency to make product discovery effortless – more so than brands in any other industry we surveyed.

But they’re also awake to the positive, business-changing potential of AI-curated experiences. They understand how AI can support many of their most critical CX objectives, from providing next-level personalization to simplifying customer journeys and touchpoints.

For many, selecting the right data partner will be a vital step. After all, AI is only as good as the information it’s working with. Before any insurance provider attempts to elevate its policyholder experience to new, AI-curated heights, it should make sure it’s building atop a robust data and identity foundation.

Read the full report

This article only covers a selection of the findings from our study. Read the full report, and you’ll discover:

- The barriers stopping insurers from creating effortless CX

- The benefits insurers expect empathic AI to deliver

- People’s attitudes about a wide range of AI/CX use cases

- Details of our research methodology and sample